Our Cooperative Journey

12 Years of Empowering Members Through Collective Growth

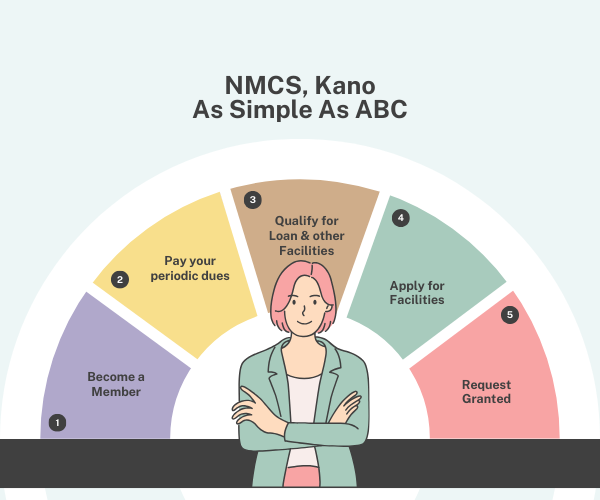

Founded in 2010, NiMet Multipurpose Cooperative Society began as a small group of 15 colleagues at the Nigerian Meteorological Agency (NiMet) in Kano who envisioned a better way to achieve financial security. What started as a modest savings club has grown into a thriving cooperative with over 120 active members from diverse professional backgrounds.

Our growth has been guided by seven core cooperative principles: voluntary membership, democratic control, member economic participation, autonomy and independence, education and training, cooperation among cooperatives, and concern for community. These principles ensure we remain member-focused while contributing positively to Kano's economic landscape.

₦150M+ in loans disbursed

87 members became homeowners

94% member satisfaction rate

₦25M in annual dividends

120+ Active

Members

M+

Loan Awarded

+

Years Of Experience

+

Team Members