Founded in 2010, NiMet Multipurpose Cooperative Society has grown from a small group of 15 members to a thriving community of over 120 active members. We operate on the cooperative principles of voluntary membership, democratic control, member economic participation, and concern for community. Our society is registered with the Kano State Ministry of Commerce and Cooperatives, ensuring full compliance with all regulatory requirements.

What sets us apart is our commitment to financial education. We conduct quarterly workshops on topics like budgeting, investment strategies, and debt management to ensure our members make informed financial decisions. Our loan approval process is transparent, with decisions made by an elected credit committee of fellow members.

Low-interest loans (as low as 5% APR)

Property co-ownership opportunities

Dividend payments on shares annually

Emergency funds for members in need

120+ Active

Members

Loan Awarded

Years Of Experience

Team Members

We offer a range of services designed to help our members achieve financial stability and growth. Each service is carefully structured to provide maximum benefit while minimizing risk.

Our loan products include:

All loans require 2 guarantors from within the cooperative and have flexible repayment periods from 6-36 months.

Read More

Our real estate services include:

Current projects include a 20-unit housing estate in Tarauni and commercial spaces in Kano's business district.

Read More

Our investment services include:

Minimum investment is ₦50,000 with professional portfolio management included.

Read More

Our savings programs include:

All savings earn 5% annual interest with withdrawal flexibility after 3 months.

Read MoreAt NiMet Cooperative, we go beyond basic financial services to provide comprehensive support for our members' success.

Free quarterly workshops on personal finance, investment strategies, and business management to help you make informed decisions.

Access to a network of like-minded professionals and business owners for collaboration and mutual support.

Death benefit coverage for all members and optional health insurance packages at discounted group rates.

Annual dividends paid on share capital and patronage refunds based on your usage of cooperative services.

Our elected officers bring decades of combined experience in finance, business, and community development to serve our members effectively.

Chairman

15 years cooperative experience

Secretary

Former bank manager

Treasurer

CPA with 12 years experience

Auditor

Forensic accounting specialist

Don't just take our word for it - hear from members who have transformed their financial situations through our cooperative services.

Member Satisfaction Rate

Repeat Loan Applicants

"The NiMet Cooperative loan helped me expand my textile business from one shop to three within two years. What I appreciate most is their personalized approach - they didn't just give me money but also connected me with other members who became my best customers. My revenue has increased by 300% since joining."

Textile Merchant, Member since 2015

"Through the cooperative's real estate program, I became a homeowner in 2020. We pooled resources with 9 other members to purchase land at wholesale prices, then cooperatively built quality homes at 30% below market cost. The process was transparent, and now I live in my dream house while building equity."

Civil Servant, Member since 2012

"As a teacher, I never thought I could invest meaningfully until joining NiMet Cooperative. Their investment club helped me start with just ₦20,000 monthly. Five years later, my portfolio is worth over ₦3.5M generating passive income. The financial literacy workshops changed my money mindset completely."

Secondary School Teacher, Member since 2017

We've compiled answers to the questions we hear most often from prospective and current members.

Unlike banks that prioritize profits for shareholders, cooperatives are member-owned and operate for the benefit of members. Key differences include:

Our loan requirements are designed to be member-friendly while ensuring responsible lending:

First-time borrowers are limited to ₦500,000 maximum, with higher limits as you build credit history with us.

NiMet Cooperative operates on democratic principles:

Each member has equal voting rights regardless of shareholding. Major decisions require 2/3 majority of members present at AGM.

Member funds are always protected:

We've never failed to return a member's funds, with average processing time of 30 days after all requirements are met.

Our member services team is available to assist you:

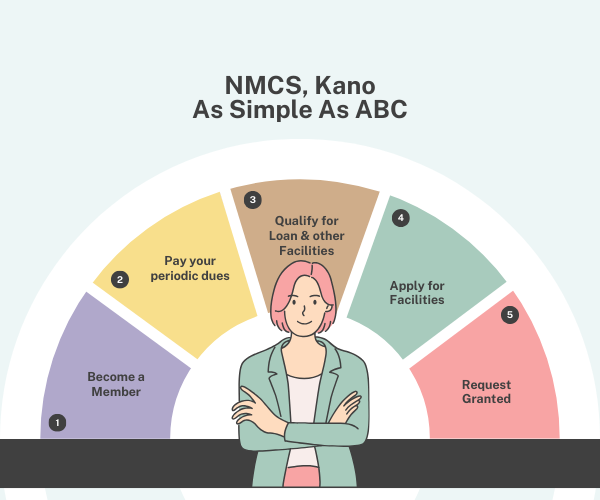

Take the first step toward financial empowerment and community support. Our membership process is simple and straightforward.

Complete our online application and attend a brief orientation session to get started.

Apply NowSchedule a consultation with our membership officer to discuss your needs.

Contact Us